Litigation Finance – A Modest Proposal

Litigation finance, broadly speaking, refers to a third party with capital that is willing to fund the costs of litigation (up to a capped amount) that an aggrieved party of limited financial means (i.e. the plaintiff) wishes to bring against a defendant. In exchange for making the funds available, the litigation funder will receive a portion of any resultant recovery.

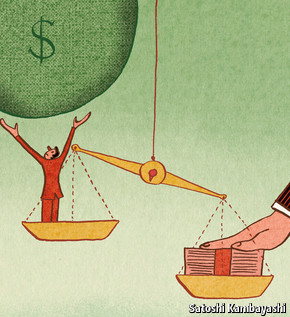

Litigation finance can equalize the bargaining power between plaintiffs, who may lack the financial means to pay litigation costs, and defendants, who may have deeper pockets and may sometimes be better able to shoulder the duration and uncertainties of commercial litigation.

Funds advanced in litigation finance are non-recourse to the claimant (i.e., the claimant need not repay amounts advanced if the case does not succeed or settle) but not inexpensive. Indeed, attorneys at our firm have recently worked on matters where the funder is to be repaid amounts ranging from 1.75 times the amount advanced if settled within 9 months from the date of funding and up to 3.5 times the amount advanced if the case settles more than 18 months from the date of funding. Alternatively, the claimants in each case would not have been able to maintain or mount a meaningful cause of action without the funding. Both matters required forensic accountants and other experts who do not work on a contingency basis.

Claimants seeking funding for litigation, and the funders who provide it, may wish to consider establishing a minimum recovery for the claimant. Setting a minimum recovery for the claimant may reduce the risk that a court will not enforce a litigation finance agreement on the grounds that it is unconscionable and may reduce any risk that a remorseful claimant later challenges the fees paid to the litigation funder.

Litigation financing ensures access to justice for claimants with meritorious claims but who lack the means to bring or sustain a cause of action. Negotiated sliding scale caps on returns to funders upon repayment, like the contingency fee limits set in Connecticut, may strike a fair deal for all sides and ensure a litigation funding agreement is enforced or, if challenged, less likely to be disturbed.

Topics: Litigation Finance | Third-Party Capital | Accountancy | Connecticut | Minimum Recovery

Work cited: John J. Hanley and Dougas Schneller | Rimon P.C. | January27, 2020