How Litigation Funding Can Enhance Law Firm Revenues

Observers of the legal profession know that law firms have been under significant economic pressure for at least a decade. Clients have become more aggressive in demanding lower hourly rates and leaner staffing. Accordingly, law firms have struggled to maintain their profit margins. In this respect, there may be a way that litigation finance can help.

In the market for legal services, demand has been flat for nearly a decade, in large part because alternative service providers have been crowding the market and more corporate legal departments bring work in house. Firms continue to raise their hourly rates, but realization percentages—that is, the percentages of rack rates that firms are actually able to collect—have been dropping since 2010. Many clients simply refuse to pay rack rates, making firms compete with each other to offer bigger discounts. Frequently, clients demand discounts of 10 percent or more.

Law firms have responded by trying to reshape their own financial structures, diminishing the number of their equity partners and hiring more young lawyers who work at lower rates without any chance of sharing profit. Unfortunately, these measures have not done much to raise profits because this restructuring has been offset by losses in productivity and increases in expenses. In this respect, the restructuring has undermined itself. Knowing that their chances of getting an equity partnership is low, many young lawyers are unwilling to bill 2500 hours per year or more to enhance firm profits that they will never share.

One way for firms to increase profits is to find a way to share risk with their clients. The best-known method for such risk sharing is the contingent fee, but many firms don’t have the economic resources to take on such risk to a great extent. In addition, it can be difficult to decide on partner compensation when a firm has to weigh the relative contributions of lawyers whose clients pay by the hour versus lawyers who work on contingency cases.

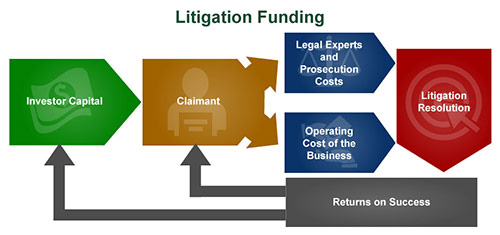

This is where litigation finance can come in. Funders can provide resources that allow for something like a “partially secured” contingency fee. That is, the client and attorney can enter a contingency fee agreement, and third-party funding can be provided as a non-refundable advance against the contingent fee. If the case results in a recovery, the advance is credited against the contingent fee; if the case does not result in a recovery, the law firm keeps the advance, reducing the damage to its realization rate.

Keywords: litigation finance, third-party litigation funding, contingent fees, risk-shifting, realization rates

Work Cited: Ross Wallin, Litigation Finance as a Tool to Increase Law Firm Rate Realization, New York Law Journal (May 4, 2018) available at https://www.law.com/newyorklawjournal/2018/05/04/litigation-finance-as-a-tool-to-increase-law-firm-rate-realization/