Litigation Finance and Antitrust Litigation

One of the fastest growing areas of litigation generally is antitrust. For a variety of reasons, antitrust cases are particularly well suited for litigation financing. Consequently, the growth in antitrust cases provides great opportunities for litigation funders as well.

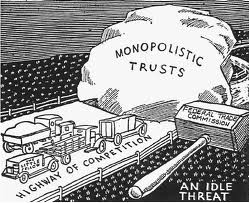

Litigation to prevent anti-competitive or monopolistic conduct is commonplace wherever there are large and sophisticated markets, including the United States, the European Union, and throughout Asia, among other places. Any allegation of anti-competitive conduct can be difficult and time-consuming to prove. In most cases, such proof comes from extensive analysis of a variety of economic phenomena and complex expert opinion.

Damages claims in antitrust cases are routinely for tens or hundreds of millions of dollars. Quite often, for the companies alleging competitive injury, the outcome of an antitrust case can determine its survival. With such high stakes, companies are willing to pursue it, but they often have trouble bearing the very high costs.

Of course this is where litigation finance comes in. For companies with an antitrust claim, litigation finance can be a way to spread risk and to help carry the economic burdens of cases that are very costly to litigation. By the same token, antitrust can be a very attractive field for funders, for a variety of reasons: the parties in antitrust cases are almost always sophisticated enterprises who are familiar with complex litigation and prepared to do what is necessary to win; the attorneys involved are equally sophisticated and well-prepared for the challenges of the case; and the defendants are usually creditworthy and willing to reach in economically rational settlements.

Antitrust is one area that demonstrates how litigation finance can help society and the economy. Antitrust law is an instrument to assure that markets operate fairly and efficiently. But if antitrust cases are too expensive to litigation, some companies will get away with anti-competitive practices that harm the economy and consumers. When litigation finance permits parties to bring meritorious antitrust claims, everyone benefits.

Topics: litigation finance, legal reform, third-party funding, litigation costs, commercial litigation, antitrust, competition cases

Works Cited: Ann Rogers, et al., Emerging Issues in Third-Party Litigation Funding:What Antitrust Lawyers Need to Know, The Antitrust Source (December 2016) available at https://www.americanbar.org/content/dam/aba/publishing/antitrust_source/dec16_full_source.authcheckdam.pdf